#realtalk. I suck at budgeting. like really suck. like that time in high-school when I missed two weeks of school because of glandular fever and that was the time they chose to teach algebra. suck.

My little sister is the queen of budgeting, frugality and living within your means, something i've always envied. So with a little (hell of a lot of) pushing from her, I've got my head out of the clouds and am so proud to have successfully budgeted for the last month.

and it was easy, seriously. i built budgeting up to this big scary, overwhelming thing and.. it's not.

but like anything else, you just have to start, it may not be perfect, or exactly how you want it - but just start!

So I sat down and looked at the way I was spending my money, I lost my debit card a few months ago so I'd been using my phone and the "tap to pay" option - which was so dangerous, just tap and go, and forget (about saving anything!)

Using Cash and only cash has totally changed the way I think about money, how I spend it, how I earn it, and what's the whole purpose of saving. I think about whether I really need/want things now, I am more connected to it as a physical thing, not just these numbers sitting in an account somewhere in the cloud.

I think you have to really figure out what's going to work for you, (I'm not saying this will work for everyone! this is just what worked for me, do some research, there are so many options out there!) when I'd decided what type of budget I wanted to start I went about researching - pinterest, blogs and google are your best friends here. I also found a few podcasts quite helpful!

Frugal Living Now - Best Cash Envelope Wallets

Seed Time - DR Cash envelope System

Pinterest - Cash Wallet

All in the Mind Podcast - The psychology of money

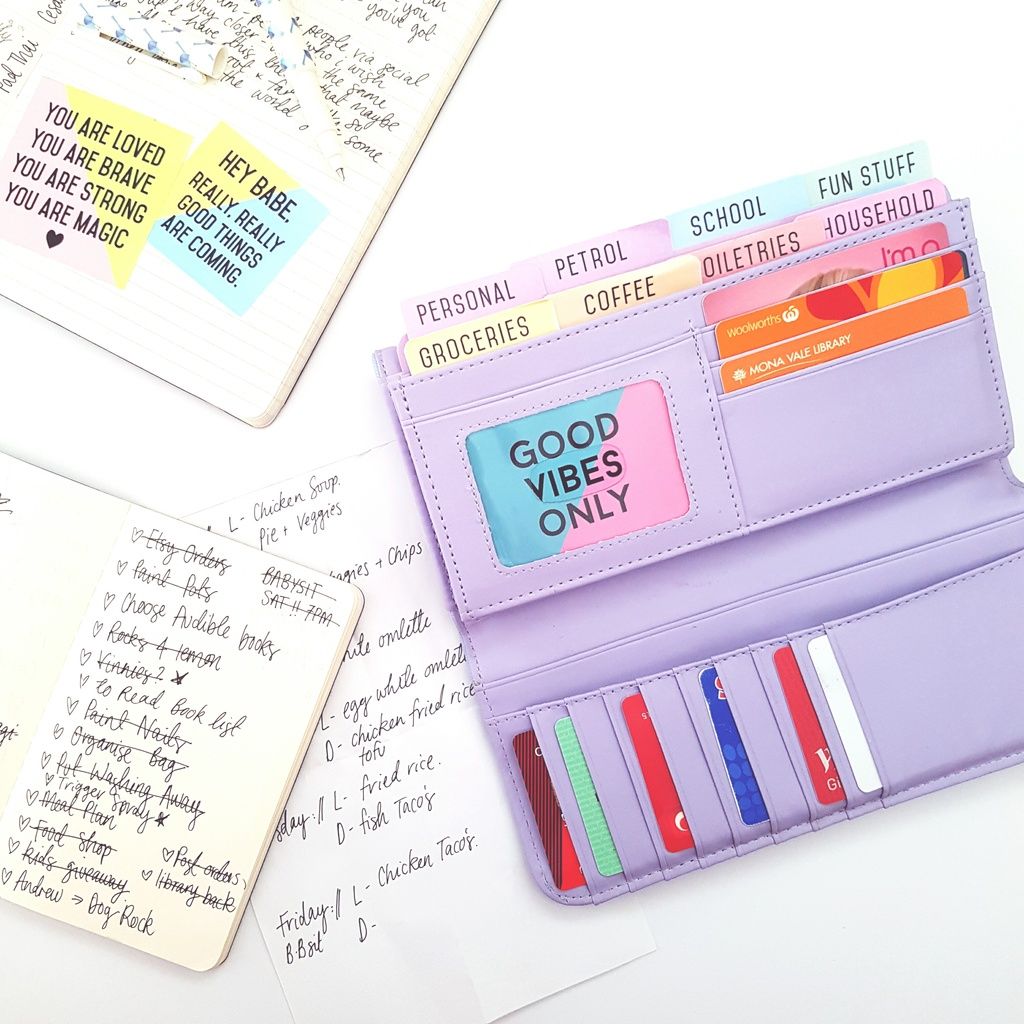

Basically after I found Dave Ramsey's Cash Envelope System i was set; It made sense to me (for the most part) But I did switch the envelopes to dividers in my wallet.

I wrote my budget using the "Simple Budget" in the Excel templates, when I had that figured out I split my expenses into 3 sections; cash I'd need to withdraw, bills to pay, and money to be moved to separate savings accounts (I have one account for my car expenses and one for holiday savings)

The bills that need to be paid; mortgage, loan, spotify etc. all get paid on pay day.

The other expenses, car insurance, holiday savings, phone bill - all get moved into their accounts on pay day too.

Then I go to the bank and withdraw the exact amount of cash required for the fortnight (I'm paid fortnightly) - Side note; it's better to go into the bank if you can, so you can get smaller bills - which you'll need to split into the dividers.

Here are the sections my dividers are split into -

In my wallet; groceries, coffee, toiletries, household, personal, petrol, school, fun stuff.

At home in a separate folder; gifts, christmas, medical, savings (ie; any extra income for the week) these are "sinking funds" and I don't access these every week, only when I need to.

In that folder I also have a second set of all the dividers to put any leftover money from the week so that;

1. so that I can see how much money i'm not spending and i can alter my budget later

2. in case i need to spend extra money on a certain group ie; get my hair cut or go to the doctors.

You can download the rainbow dividers I made here -

(yes! for free! we're on a budget!) They're blank so you can use photoshop, Illustrator or Word to add a text onto the tab, then resize, crop or trim them when you've printed them to fit your wallet - measure first!

I printed them on 250gsm matte card and laminated them at my local officeworks.

A few lessons learnt:

+ this won't work for everyone, you need to take in to account your financial situation, home situation and what you spend your money on, do the research; really sit down and think about it, listen to the podcasts, inform yourself, it'll make it easier.

+ Handling cash has made a big difference for me - I've only used my debit card once in 4 weeks (to buy chicken soup x3 one weekend when I was sick!) I've disabled tap and go on my phone and I have really been asking myself "Do I need this?, Why do i need this? what purpose will it serve?"

+ It's all you'll think about, stress about, worry about for the first 3 weeks - push through, it'll get easier and become second nature.

+ make it easy by making it fun & pretty! find a nice pretty wallet, put colour into your spreadsheets, lists, dividers!

+ meal planning is your friend - I sit down on a friday/saturday and plan all my meals for the week, trying make dinners that will have leftovers for lunch and making my breakfast in bulk!

+ try not to deprive yourself of the all the fun stuff completely, @alyssajtasker likened it to a diet, if you don't allow yourself a treat every once in a while, you're going to binge at some point.

I'm trying to be as transparent and real life as possible, if I can help you I want to! Please if you have any questions comment below or email me; paperedthoughts@gmail.com and i'll do my best to answer them!

Awesome post! Thanks so much for sharing I am also new to the budgeting and frugal lifestyle. It's so nice to see others in the same boat as you making positive changes. Can't wait to see your budget updates!

ReplyDelete